Protect Your Company From Liability Claims

Here at ProfessionalsCoverage, we understand that every Ontario business is at risk of being sued at some point in the future. We know that you probably stay awake at night worrying about your company’s future. Do not worry, because there are insurance policies that can make a huge difference. General liability insurance or business liability insurance is going to go a long way towards protecting your company from liability claims. This type of insurance policy can protect you from a wealth of potential problems, including property damage, personal injury and other problems caused by your business operations.

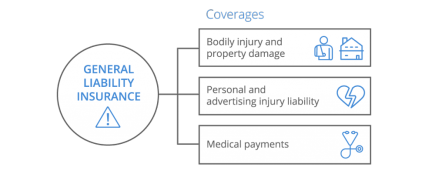

When you acquire a general liability quote, there are specific coverages that will usually be included. They’ll be listed below for your consideration.

- Bodily injury

- Property damage

- Medical costs

- Products and projects completed

- Rented premises damage

- Advertising injury

These coverages are absolutely essential for any business in Ontario, Canada. ProfessionalsCoverage can help you get the insurance that you need to sleep a little more comfortably at night.

Do You Need General Liability Insurance? & Why?

There are some business owners in Ontario who mistakenly believe that they do not need business liability insurance. This couldn’t be further from the truth. The truth of the matter is that pretty much every single business in Ontario is going to need this insurance. If they do not have it, they’re taking a huge risk. You can often combine GLI with a BOP or business owners policy. As a contractor in Ontario, you can acquire general liability as a stand-alone package. Either way, getting coverage is essential for small business owners, contractors and enterprises.

Just think about it. It really only takes a single mistake or accident to get sued. Your company might not be able to survive a single lawsuit. To shield yourself from the risks, you really need to get covered as quickly as possible. In fact, you should not serve a single client until you’ve gotten the GL that you need! At the same time, you need to realize that some clients and employers will demand it.

Without the insurance, your chance of landing the big job is going to be decreased significantly. So, it is really in your best interest to get the coverage that you need right now!

Many business owners are not interested in getting this liability insurance. They believe that the insurance is nothing more than a scam. This is a fallacy. Liability insurance can protect your business thoroughly. It can help protect you from many types of lawsuits. ProfessionalsCoverage recommends that you get covered with GL insurance today! If you run a business in Ontario, you may want to

combine it with a BOP. Either way, we’re here to help you!

Contractors General Liability Insurance

Contractors do not always need a business owners policy. If you’re a contractor, you might be able to save yourself some money by only acquiring a stand alone contractors general liability insurance policy. This is a good option, if you do not own any commercial buildings. Just remember that this doesn’t mean that you’re not prone to risks. After all, anything could go wrong with the projects that you complete. Therefore, you are still going to be exposed to many liability risks along the way.

This is why you should try to acquire G L I without BOP insurance. ProfessionalsCoverage can help. Our company offers many insurance products to our clients. We can help you acquire general liability, blanket additional insured coverage, and many other options. Remember that some employers will require you to obtain blanket additional insured coverage. If you need it for a specific project, we can help you get it!

The Average Cost Of General Liability Insurance

There is no doubt that all Ontario contractors and business owners are going to be concerned about the costs of insurance. After all, many business owners try to avoid the coverage, because they’re afraid of the costs. Just remember that there is no universal price. Two companies in the very same industry could have entirely different prices. There are tons of factors at play when it comes to determining the cost of general liability insurance. In order to determine exactly how much you’re going to be required to pay, you’ll need to speak with a professional broker.

ProfessionalsCoverage is here to help. Our company can help you figure out whether or not you qualify for coverage through us. Then, we can take down your information and provide you with an accurate and honest quote. You can acquire a quote from us very easily. You can do so by contacting is via email or phone. You can also complete the form online and get a quote much sooner.

Getting Comprehensive Coverage With A BOP

Here at ProfessionalsCoverage, we understand that many Ontario contractors will be satisfied with just a basic general liability policy. However, we also know that this isn’t going to be enough for some business owners in Ontario, Canada. We’re versatile enough to help you get the coverage that you need right now. If you want to acquire just this policy as a stand-alone, we can help. Alternatively, we can also help you acquire a business owners policy that offers a much broader range of coverages.

If you want to get as much coverage as possible, acquiring a BOP is highly recommended. When you’re ready to get started, you just need to get in touch with the professionals at ProfessionalsCoverage. We’ll guide you in the right direction and help you acquire the price insurance that you need!

Start now by getting a free Quote!